Ever noticed a cryptic code on your credit report, specifically one that reads "JPMCB Card Services?" Understanding what this code signifies is crucial for maintaining a healthy credit profile, and it's simpler than you might think.

JPMCB Card Services, in essence, is shorthand for JPMorgan Chase Bank Card Services. This designation is a marker on your credit report, frequently appearing when you've interacted with Chase Bank regarding credit card applications or account activity. Its appearance can range from a standard record to a more significant indicator, depending on the nature of your interaction with the financial institution.

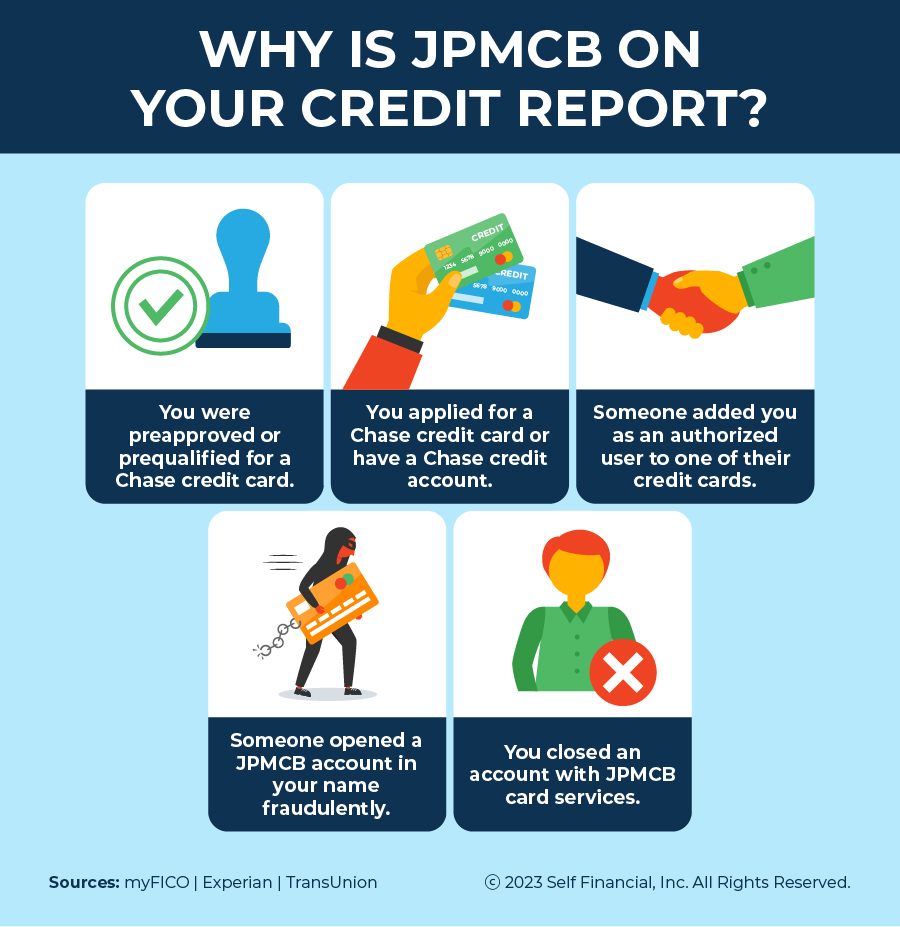

In many cases, "JPMCB" on your credit report represents a hard credit inquiry. This is a direct result of applying for a Chase credit card. The bank performs a hard inquiry to assess your creditworthiness before making a decision on your application. This type of inquiry can slightly impact your credit score, but its a standard practice and a necessary step in obtaining a new credit card. It's also important to know that if you've been added as an authorized user on someone else's Chase card, this could also lead to the appearance of "JPMCB" on your report.

- Sam Elliotts Military Service What You Need To Know

- Onlyfans Leaks Influencer Drama What You Need To Know

However, "JPMCB" can also appear as a soft inquiry, which doesn't affect your credit score. This could be due to pre-approved offers or account reviews. Regardless of the type of inquiry, the key is to recognize what the code means and to verify its accuracy, especially if you havent recently applied for a Chase credit card or become an authorized user. Should you find "JPMCB" listed without any corresponding activity on your part, it's wise to investigate the matter further by reviewing your credit report and contacting the credit bureau.

Consider this scenario: you review your credit report and spot "JPMCB" listed, but you haven't applied for a Chase credit card. This could be due to a few reasons. Perhaps a family member, such as a parent, spouse, child, or even a business partner, has applied for a Chase card and listed you as an authorized user. Alternatively, there's always the possibility of identity theft or fraudulent activity, where someone might be using your information to apply for a credit card without your knowledge.

The core function of "JPMCB Card Services" is to function as an identifier, indicating activity related to your credit profile concerning JPMorgan Chase Bank credit products. It's a standard practice for financial institutions to report to credit bureaus, and this is how the system tracks your credit history, ensuring accuracy and providing lenders with necessary information.

When you come across "JPMCB" on your credit report, its importance lies in its connection to Chase credit cards. JPMorgan Chase Bank offers a wide array of credit cards for both personal and business use. These cards boast various features, including rewards programs, cash back offers, and other perks tailored to meet the diverse needs of cardholders. For instance, some cards provide bonus categories for spending, such as dining, travel, or gas, thereby enabling you to earn rewards more effectively. Furthermore, benefits may extend to travel insurance, purchase protection, and extended warranties.

Several types of credit cards are available from Chase, designed for various purposes. Reward cards focus on rewarding your spending habits through points or miles, which you can redeem for travel, merchandise, or other incentives. Cash-back cards provide a percentage of your spending back to you in the form of cash or statement credits. Balance transfer cards allow you to consolidate your existing debt by transferring balances from other cards to a Chase card, often with promotional interest rates, making debt management easier. Business credit cards are catered towards business owners, providing features like expense tracking and access to business-related rewards.

Let's illustrate this with a real-world example. The Chase Freedom Flex card offers 5% cash back in bonus categories each quarter that you activate, along with 5% cash back on travel booked through Chase Travel, 3% back on dining, 3% back on drugstore purchases, and 1% back on all other purchases. This versatility makes the Chase Freedom Flex a good option for those who like to maximize their rewards. Other cards, such as the Chase Sapphire series, offer a premium experience with travel rewards and benefits.

Understanding the presence of "JPMCB" on your credit report is a critical first step. The second step is to ensure accuracy. Review your credit report carefully to confirm that the information is correct. Make sure that all accounts listed under "JPMCB" are accounts you have opened or authorized. If you spot any errors, you have the right to dispute them with the credit bureau that issued the report. This is vital because any inaccurate information on your credit report can potentially harm your credit score.

Should you see "JPMCB" and have no associated Chase card or no recent application, you have the right to dispute the entry. Contact the credit bureau that produced the report and provide them with the details of the error. The credit bureau is legally required to investigate your dispute and to correct any errors within a specific timeframe. This process helps maintain the integrity of your credit report.

Another factor to consider is the potential for fraudulent activity. If you do not recognize the "JPMCB" listing on your credit report, it could be a sign that someone is attempting to use your personal information to open a Chase credit card without your knowledge. This is a serious issue that needs immediate attention. If you suspect fraud, you should immediately report it to the credit bureaus and Chase Bank. Additionally, you should consider placing a fraud alert or credit freeze on your credit files to prevent further unauthorized activity.

You can contact the credit bureau to dispute the information. Most credit bureaus offer online dispute forms, or you can send a written dispute letter. Be sure to include all the necessary documentation, such as your identification, proof of the error, and any other supporting evidence you have. By taking swift action, you protect your credit profile and mitigate any potential damage.

The key is to actively monitor your credit report regularly, typically at least once a year or more often if youre actively applying for new credit. Numerous resources are available to help you track your credit. You can obtain free credit reports from each of the major credit bureaus annually at annualcreditreport.com. You can also use credit monitoring services, which often provide alerts when changes occur to your credit report. This monitoring can help you spot any potential problems, such as unauthorized credit inquiries or accounts, quickly and address them promptly.

Chase credit cards offer numerous benefits, making them a popular choice for many consumers. They can assist you in making purchases, earning rewards, and building your credit history. With several options available, you can find a card that fits your lifestyle and financial goals. Some cards offer excellent rewards programs and opportunities for cash back. Furthermore, Chase provides tools like Credit Journey, where you can obtain a free credit score and receive insights into your credit profile. By understanding the features of each card, you can choose the one that best suits your needs.

Chase also provides different options to manage your credit card accounts, one of which is credit card autopay, which simplifies the payment process by automatically deducting money from your bank account to pay your bill. You can schedule payments for a specific day each month and choose the amount to pay, whether the minimum due, the full statement balance, or a custom amount. This feature helps you avoid late fees and maintain good credit standing.

Many consumers also use their cards to pay for the items they need. Understanding the importance of each card and the rewards it offers is important. The card you choose will reflect your lifestyle, your goals, and how you plan to manage your finances. Whether you prioritize cash back on everyday purchases or travel rewards for vacations, the right credit card can be a powerful tool.

Chase offers various credit card services, including the ability to report lost or stolen cards, report fraud, or dispute charges. Chase provides dedicated customer service numbers to assist with business credit card queries. These services ensure that cardholders can quickly address any issues or concerns, promoting a secure and convenient credit card experience.

When dealing with a JPMCB-related inquiry, whether it's a hard or soft check, the correct steps depend on your situation. If you have a Chase card and recognize the inquiry, you don't need to take any action. However, if you don't have a Chase card and do not recognize the inquiry, it's essential to investigate the matter. Review your credit report, check for unauthorized activity, and contact the credit bureau to file a dispute.

Here is a table that provides a comparison of various JPMCB card services vs. American Express for fees and global acceptance.

| Feature | JPMCB Card Services | American Express |

|---|---|---|

| Annual Fees | Competitive, Vary by Card | Potentially Higher |

| Global Acceptance | Extensive, Similar to Visa/Mastercard | Generally Wider, but varies. |

| Business Tools | Extensive, Similar to Visa/Mastercard | Excellent, but can vary. |

| Rewards Programs | Diverse, Catered to cardholder needs | Various types of rewards, depends on the card. |

| Customer Service | Readily Available, 24/7 | Similar to JPMCB's. |

JPMCB, or JPMorgan Chase Bank, stands as a significant player in the credit card market. Knowing what this code means on your credit report equips you with the knowledge to manage your credit health proactively. Regularly checking your credit report, understanding the different types of inquiries, and addressing any discrepancies promptly are essential practices.