Is it possible to predict the future of the stock market, and can Dylan Jovine's insights truly offer a glimpse into tomorrow's investment opportunities? The world of finance is constantly shifting, and understanding the strategies of successful investors like Jovine could be the key to unlocking financial growth.

The queries regarding Dylan Jovine's latest investment strategies and, specifically, his "takeover targets" have been generating considerable interest. Subscribers and prospective investors alike are eager to understand the efficacy of his approach, particularly as the market dynamics continue to evolve. As we approach the end of May, the anticipation surrounding his teased "takeover target" is palpable. Will it culminate in a lucrative offer, or is it merely a cleverly constructed marketing tactic designed to attract subscribers to his $997/yr "takeover targets service"? This question is at the forefront of many minds, and the answer remains elusive.

| Category | Details |

|---|---|

| Name | Dylan Jovine |

| Role | Founder and Editor of "Behind the Markets" |

| Background | Former Stock Analyst, Founder of Lexington Capital Partners and Tycoon Publishing |

| First Encounter with Stocks | Wall Street, 1991 |

| Mentorship | Hired by Peter Jaquith, investment banker |

| Investment Strategy Focus | Not limited to any specific market sector; focuses on sectors with potential returns. |

| Current Favorite Sector | Biotech (though this can vary) |

| Investment Advice Delivery | Subscription email newsletter, courses |

| Key Services | "Takeover Targets" service ($997/yr) |

| Presentation Notable | "End of Disease" |

| Notable Experience | Founding Lexington Capital Partners and Tycoon Publishing |

| Website (Reference) | Example Website (Replace with an authentic source) |

Numerous reviews indicate that Dylan Jovine's stock picks have demonstrated varying degrees of success, heavily dependent on the specific company, the investor's entry point, and the broader market trends. Notably, his strategies appear to have yielded favorable outcomes during the bull markets of 2018 and 2021. However, the volatility of the stock market, and the nuanced nature of investment decisions, highlight the need for a balanced perspective when considering his recommendations.

- Frankie Muniz Elycia Turnbow Relationship Drama 911 Calls Details

- How Did Tracy Wilson From Alone Die Unveiling The Truth

The "takeover target" concept, as promoted by Jovine, is a cornerstone of his current offerings. It's the kind of high-stakes proposition that captivates investors with the promise of significant gains. While waiting for a specific "takeover target" to yield results may seem a gamble, the potential rewards can be substantial. As Jovine continues to refine his strategies and adapt to the changing market landscape, investors remain keen to observe the performance of these carefully selected opportunities.

Dylan Jovine's foray into the world of finance dates back to 1991, when he initiated his journey on Wall Street. His early experiences were shaped by his association with Peter Jaquith, an investment banker renowned for his role in averting New York City's bankruptcy in the 1970s. This association would have provided Jovine with invaluable insights into the complexities of financial markets and high-stakes decision-making.

The core of Jovine's philosophy centers on a dynamic approach to investment, where flexibility and adaptability are key. He is not constrained by a specific market sector. His ability to shift focus, depending on where the most promising returns can be found, is a testament to his understanding of market dynamics. While biotech may be a current favorite, his commitment to following the money illustrates a pragmatic approach designed to maximize gains for his subscribers.

- Andrew Mccarthy Net Worth How He Built His 12m Fortune

- Ed Helms Birth Family Career Everything You Need To Know

Jovine disseminates his insights via a subscription-based email newsletter and offers courses for individuals seeking to navigate the complexities of self-directed investing. His educational resources provide subscribers with access to the knowledge and tools they need to make informed decisions, and potentially improve their investment outcomes. His commitment to a dynamic investment philosophy further cements his credibility as an expert voice in the financial world.

The "Behind the Markets" service, which Jovine leads, is supported by a capable team. This collective experience and expertise contribute to the analytical rigor underpinning Jovine's investment recommendations. The combination of his personal background, experience, and the team's combined knowledge, aims to provide subscribers with a well-rounded perspective on market opportunities.

The efficacy of services like those offered by Dylan Jovine is frequently a topic of discussion. The value proposition lies in access to experienced analysis, specialized insights, and a curated selection of investment opportunities. Potential subscribers should carefully weigh the benefits and drawbacks before committing to a subscription. This includes evaluating the pricing model, the track record of past recommendations, and considering independent reviews and feedback.

Investors often seek out reviews and ratings to evaluate the performance of any investment advisory service. These reviews often provide valuable perspectives, highlighting both the strengths and weaknesses of the recommendations provided. While past performance is not a guaranteed indicator of future results, a review of the track record can provide a sense of consistency and reliability. Examining the criticisms can highlight potential risks or areas of caution.

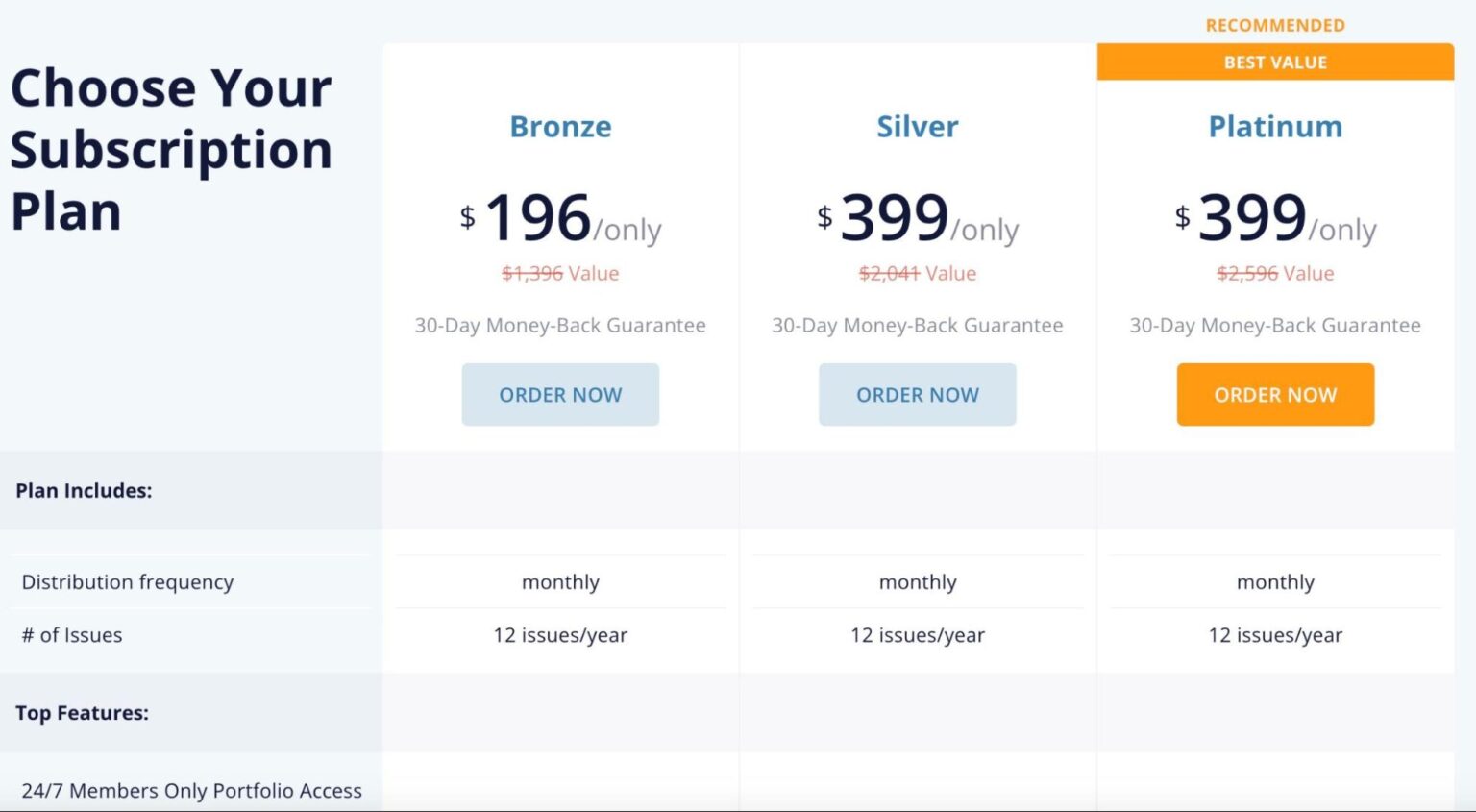

The $997 annual fee for the "Takeover Targets" service represents a significant investment. Subscribers should carefully consider the potential returns against the cost, and also evaluate the overall value provided. Those considering a subscription should fully grasp the details of the service, including the frequency of recommendations, the level of support, and the type of resources offered to subscribers.

The "End of Disease" presentation, one of the services offered by Jovine, represents a specific theme that resonates with many investors. The idea of aligning investments with breakthroughs in medical science is a particularly powerful concept, and has broad appeal. The focus on the biotech sector aligns with Jovine's current investment preferences. However, it's important for prospective investors to conduct thorough due diligence to ensure that their investments align with their personal risk tolerance, and their investment goals.

The inherent volatility of the stock market underscores the importance of understanding risk management when investing. Jovine's recommendations, like those of any investment advisor, should be considered as part of a diversified portfolio. Risk tolerance, time horizon, and investment goals should all be carefully considered before allocating any funds to his recommendations.

In summary, Dylan Jovine has cultivated a notable presence in the investment advisory space, characterized by his experience, his willingness to adapt to changing market conditions, and a focus on identifying promising opportunities. His "Takeover Targets" service and other offerings attract considerable interest and scrutiny. However, potential subscribers should conduct due diligence, evaluate the costs and benefits, and consider the risks before subscribing.

- X20gypsy Rose Blanchard Chilling Crime Scene Photos Resurface

- Randy Mosss Family Wife Facts Insights You Should Know